CREDIT INFO

What is a Credit Score?

A credit score is a number generated by a mathematical formula that is meant to predict credit worthiness. Credit scores range from 300-850. The higher your score is, the more likely you are to be approved for a loan at a favorable rate. The lower your score is, the less likely you are to receive a loan at a good rate. If you have a low credit score and you do manage to get approved for credit, then your interest rate will be much higher than someone who had a good credit score and borrowed money. Therefore, having a high credit score can potentially save you thousands of dollars over the life of your mortgage, auto loan, credit card or any other financed purchase.

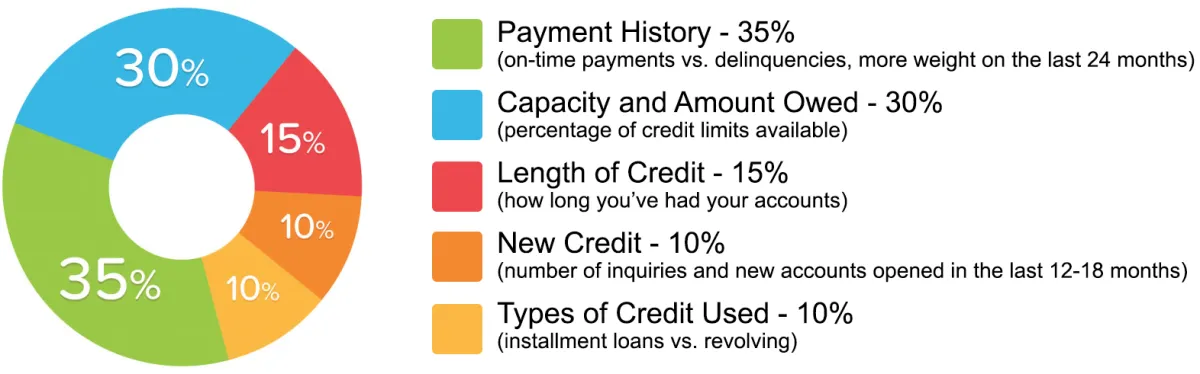

What affects your Credit Score?

We will help you dispute negative items in your payment history.

We will show you how to maximize your debt ratio score, even if paying off credit cards is not an option.

We can also help you with removing credit inquiries from your credit report. Most people are aware of the three credit reporting bureaus; Experian, Equifax and TransUnion. The average difference in scores between the highest and lowest of your credit scores from the three bureaus is frequently 60 - 90 points. This is normally the result of the credit bureaus disclosing different items on their reports which may be correct, incorrect or are not reported properly in full compliance with Federal credit laws. According to a recent study, nearly 79% (+) of all credit reports have serious errors on them. Our Staff will work to find and remove them by holding the Creditors and Credit Bureaus accountable with adherence to Federal Laws.

If we cannot remove at least 25% of the existing negative credit items from all three of your credit reports during the 6 to 8 months that you are a client of Credit Repair of Texas Inc, we will refund 100% of your fee that you paid for our Services.

In addition to starting the credit dispute process with you, what can I do to help raise my credit score as quickly as possible?

Pay all of your bills on time, every time. This includes your utility bills, mortgage and auto payments along with all of your revolving lines of credit like credit cards. Check your credit report several times a year. Our ongoing Credit Monitoring Service enables you to easily manage the status of your credit reports. You will find out how we challenge bad information on your credit report when you review our website. Also take a minute to visit our Resources tab on the far right side of the Home Page, to look at some of the Credit Builder Products available to help you increase your Score. Examples from a couple options include our Rent Reporter solution that captures your home or apartment rental history and reports it to the Credit Bureaus to help improve your Score. There are other solutions available on our Resources page that can also help you.

Never charge more than 30% of the available balance on any of your credit cards. Banks like to see a nice record of on-time payments and several credit cards that are not maxed out. If you are carrying high balances on your credit cards, then make paying them down below 30% your top priority. Certainly use your credit cards. Many people who make mistakes with their credit believe that the best way to fix things is to never use credit again. But this is not correct. If you are afraid that you cannot manage your credit cards correctly, then the best policy for you to follow would be this one: Charge only your utility bills on your credit cards each month and then auto pay the balance in full three days prior to the due date. This ensures that your utility bills are always paid and your monthly credit card payments are also automatically applied to your accounts and are never late. As long as you maintain the habit of paying off your credit card balance each month, your score should continue to go up. Leave the credit cards locked in a safe or drawer at home when not in use and avoid going on unnecessary spending sprees which could hurt your credit scores.

Keep your accounts open as long as possible, even if you are no longer charging on the card. The best policy is to keep those unused accounts open, blow the dust off your card every few months to make a small purchase and then pay it off. How long each of your accounts has been active is a major factor in your credit score. Remember that this process takes time . Following the above steps consistently over a long period of time will increase your credit score and allow you to qualify for better loans and lower interest rates. Repairing your credit score does not happen overnight, so if you do these things for a few months and do not see a large increase in your score, do not give up. These positive habits should be maintained throughout your life. Doing so will help you keep your finances and lines of credit under control.

How long will certain items remain on my credit file?

Delinquencies (30 - 180 days late): A delinquency may remain on file for seven years from the date of the initial missed payment.

Collection Accounts: May remain seven years from the date of the initial missed payment that led to the collection (the original delinquency date). When a collection account is paid in full, it will be marked as a "paid collection" on the credit report.

Charged-off Accounts: When a delinquent account is sent to a collections company, this information will remain for seven years from the date of the initial missed payment that led to the charge-off, (the original delinquency date), even if payments are made later on the account.

Closed Accounts: Closed accounts are no longer available for further use and may or may not have a zero balance. Closed accounts with delinquencies remain for seven years from the date they are reported closed, whether closed by the creditor or by the consumer. However, the delinquency notation will be removed seven years after the delinquency occurred when pertaining to late payments. Positive closed accounts continue to be reported for ten years from the closing date.

Lost Credit Card: If there are no delinquencies, credit cards reported as lost will continue to be listed for two years from the date the creditor is contacted. Delinquent payments that occurred before the card was lost are reported for seven years.

Bankruptcy: Chapters 7, 11, and 12 will remain on one's credit report for ten years from the filing date. A Chapter 13 bankruptcy is reported for seven years from the filing date. Accounts included in a bankruptcy will remain for seven years from the date first reported as delinquent and should be included in the bankruptcy.

Judgements: Remain seven years from the date filed and may be renewed by the holder, thus extending the reporting period on file.

City, County, State and Federal Tax Liens: Unpaid tax liens remain for fifteen years from the filing date. A paid tax lien may remain in one's credit file and affect their score for 10 years from the date of payment.

Inquiries: Most inquiries listed on one's credit report will remain for two years. All inquiries must remain for a minimum of one year from the date the inquiry was made. Some inquiries such as employment or pre-approved offers of credit will only appear on the copy of the credit report pulled by the individual and may not be visible when other potential employers obtain your credit reports.

Information that cannot be included in a credit report:

Medical information (unless you provide consent).

Notice of bankruptcy (Chapter 11) more than ten years old.

Debts (including delinquent child support payments) more than seven years old.

Age, marital status, or race (if requested from a current or prospective employer).

IF YOU ARE CURIOUS ABOUT HOW YOUR CREDIT SCORE WOULD RAISE...

Start your journey with us right now. This is the best time to take the step. Change your life now!

OUR CLIENT'S

TESTIMONIALS

Bill C.

⭐⭐⭐⭐⭐

"I highly recommend you speak with the staff at Credit Repair of Texas, Inc. They do an excellent job helping their clients and have one flat price which includes everything you need."

Robert A.

⭐⭐⭐⭐⭐

"Words cannot express my gratitude for the help they gave me cleaning up my Credit Reports. Everything for my three Bureaus was done online and finished in less than 6 months."

Rachel E.

⭐⭐⭐⭐⭐

"If you live in Texas and have issues with information on your Credit Reports, then speak with these people. Other companies charge more and you are not sure what you get."

GET THE CREDIT SCORE YOU DESERVE!

Get your FREE consultation today!

© 2025 All Rights Reserved | Credit Repair of Texas, Inc.